WooCommerce tax exemption is a feature of the popular eCommerce platform WooCommerce, allowing merchants to exempt specific customers from taxes.

This is useful for merchants with customers in certain jurisdictions, such as tax-exempt organizations, which are not subject to sales taxes. This feature can be enabled with the help of a plugin or by manually entering the tax-exempt information for customers on the checkout page.

Today, we will show you how to use the WooCommerce tax-exempt feature with WholesaleX. So, let’s not waste any time and get right into it.

What is WooCommerce Tax Exemption?

Tax exemptions for customers can be enabled in WooCommerce by adding the customer’s tax exemption information to their account. This information can be entered manually for each users, or the merchant can use a plugin like WholesaleX WooCommerce B2B solution to automate the process. Once the exemption is enabled, the customer will no longer be charged taxes on their purchases.

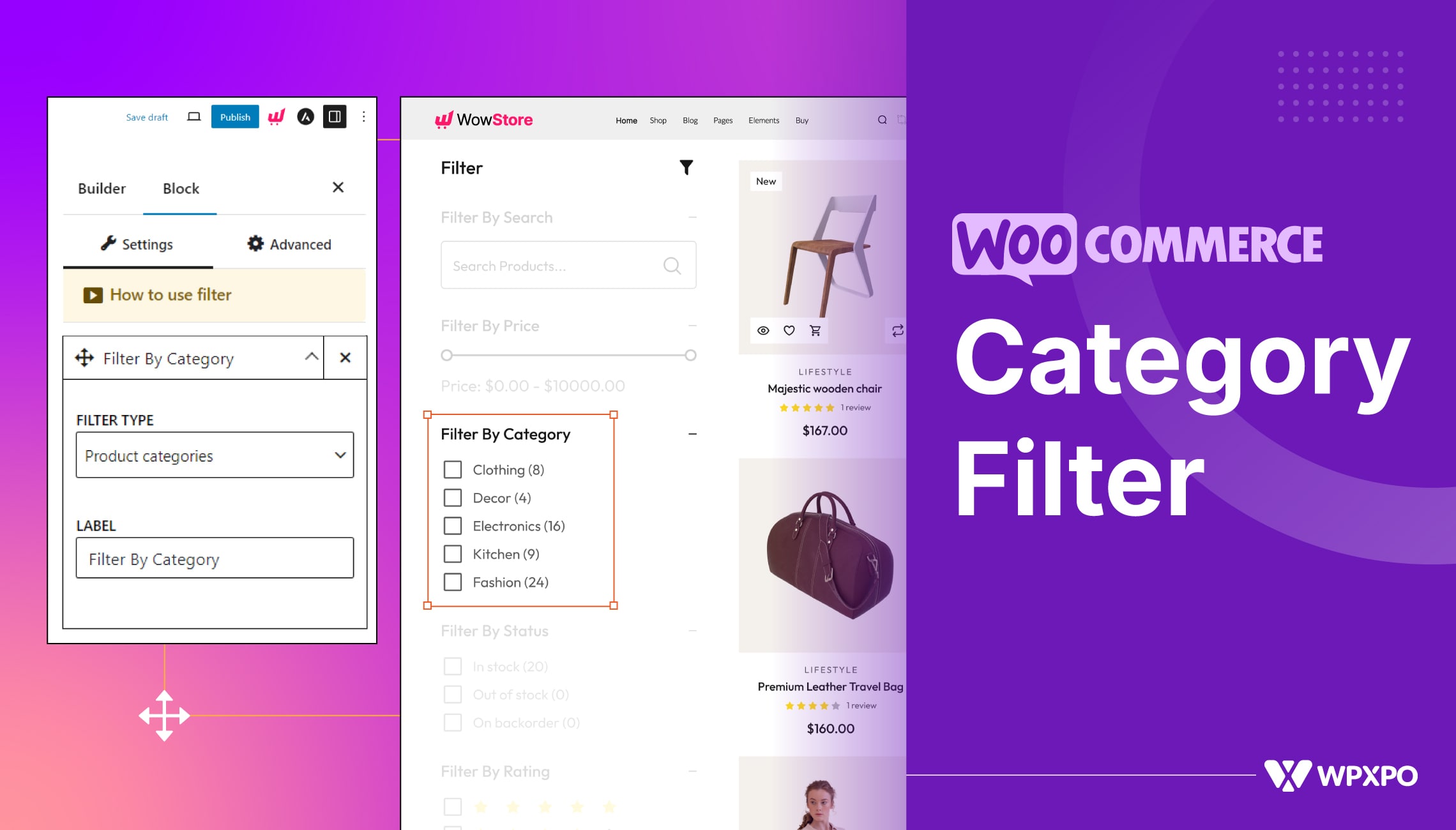

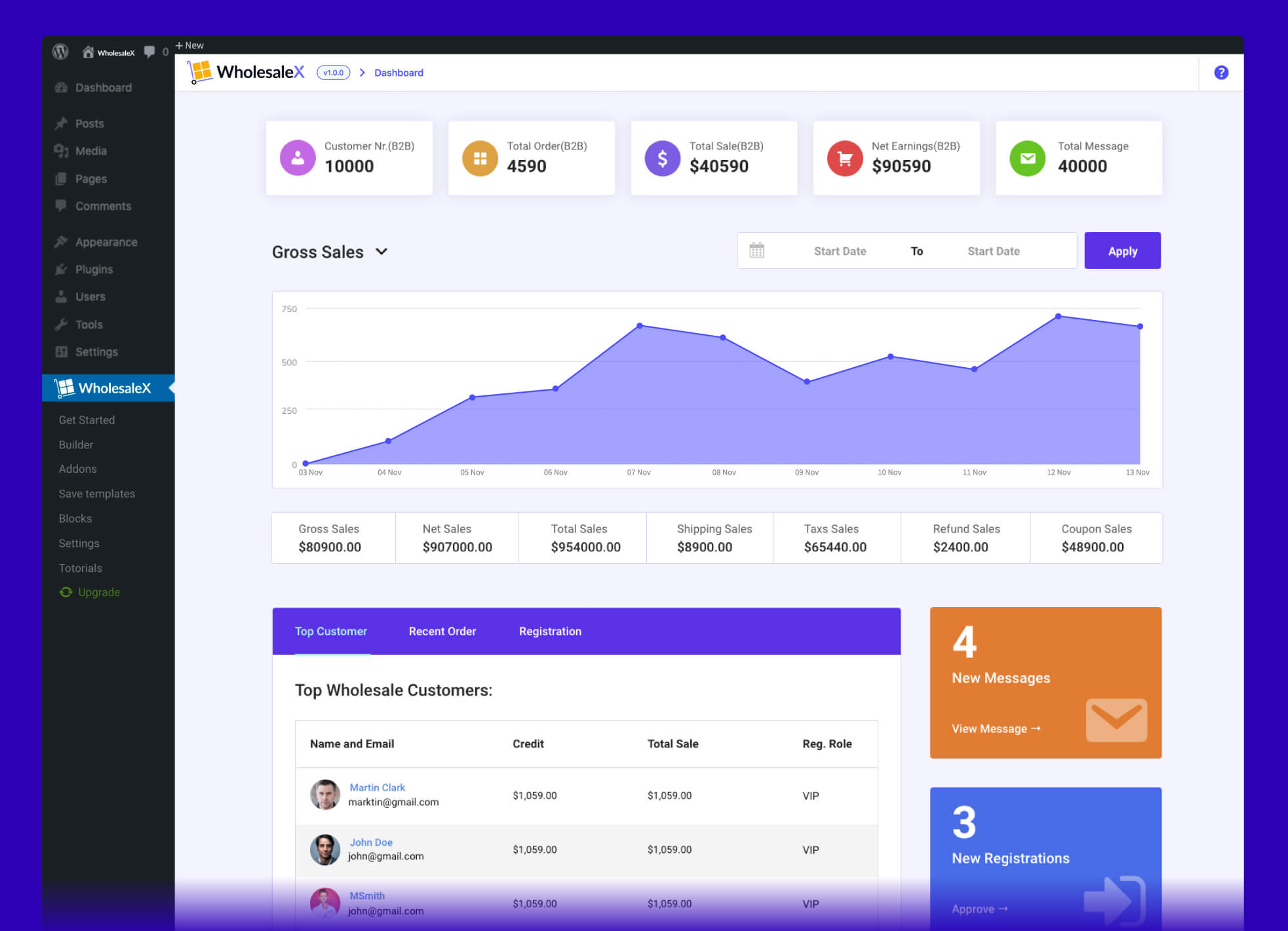

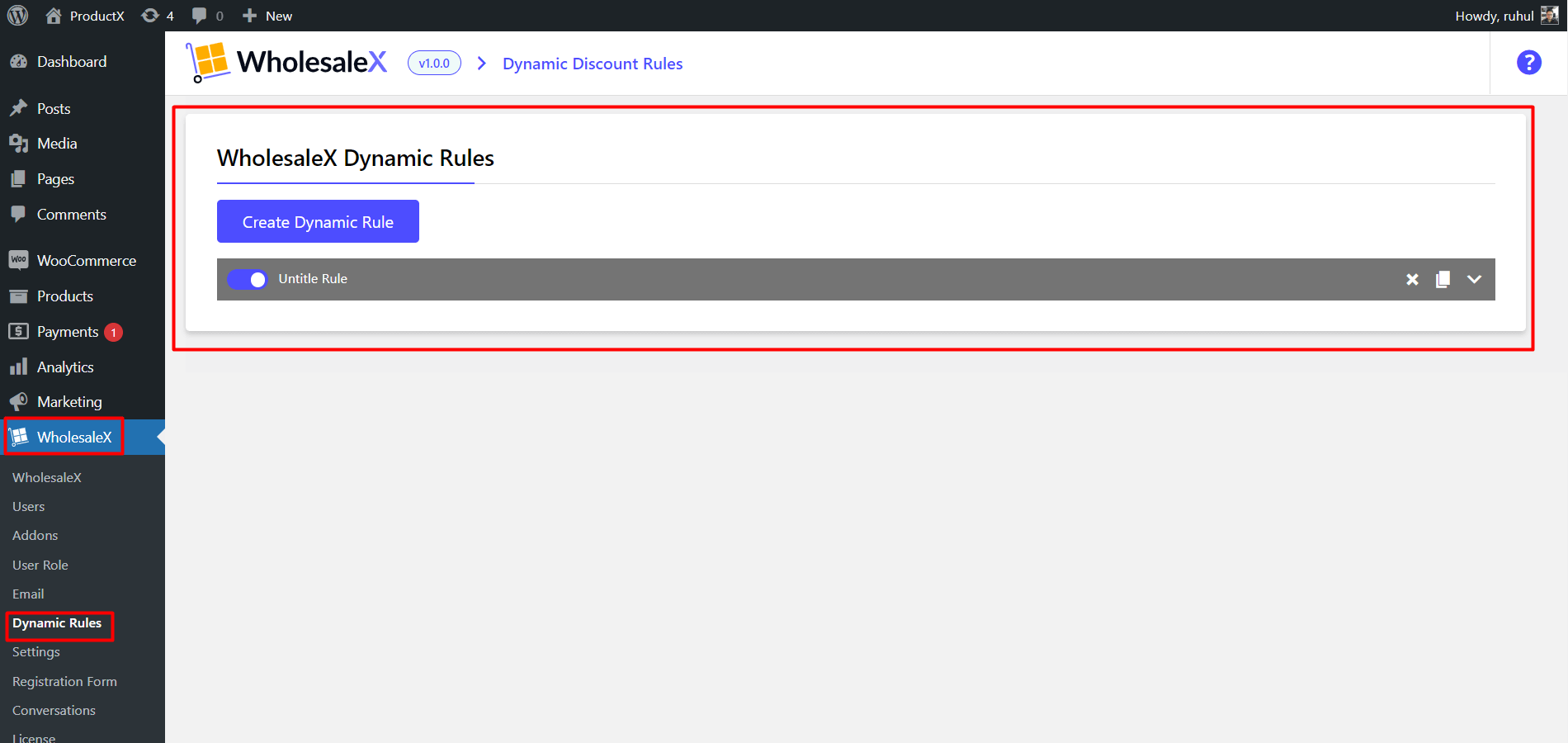

Here’s a preview of the WholesaleX dashboard:

For merchants, the WooCommerce tax-exempt feature effectively ensures compliance with local and international tax laws. It helps to ensure that customers are not charged taxes they are not legally required to pay. Additionally, this feature helps merchants to avoid costly penalties associated with failing to collect taxes from customers who are not legally required to pay them.

In addition to enabling tax exemptions for customers, merchants can also use the WooCommerce tax-exempt feature to set up automatic tax exemptions for specific product categories, such as books or digital items. This can help simplify the process of managing taxes since the merchant will no longer need to set up exemptions for each item manually.

The WooCommerce tax-exempt feature is also helpful for merchants with customers in multiple countries or jurisdictions. By enabling tax exemptions for specific customers, the merchant can ensure that the customers are not charged taxes that are not applicable in their jurisdiction. This can reduce the cost of international transactions and make them more affordable for customers.

Finally, the WooCommerce tax-exempt feature is a great way to simplify the tax management process. Automating the process saves merchants time and resources when collecting customer taxes. This helps reduce the burden of managing taxes for merchants, which helps to improve their overall profitability.

How to Set a WooCommerce Tax Exemption?

Now, let’s move into the essential part of this article: setting up the WooCommerce tax-exempt feature. We will be using WholesaleX to implement it.

Installing WholesaleX

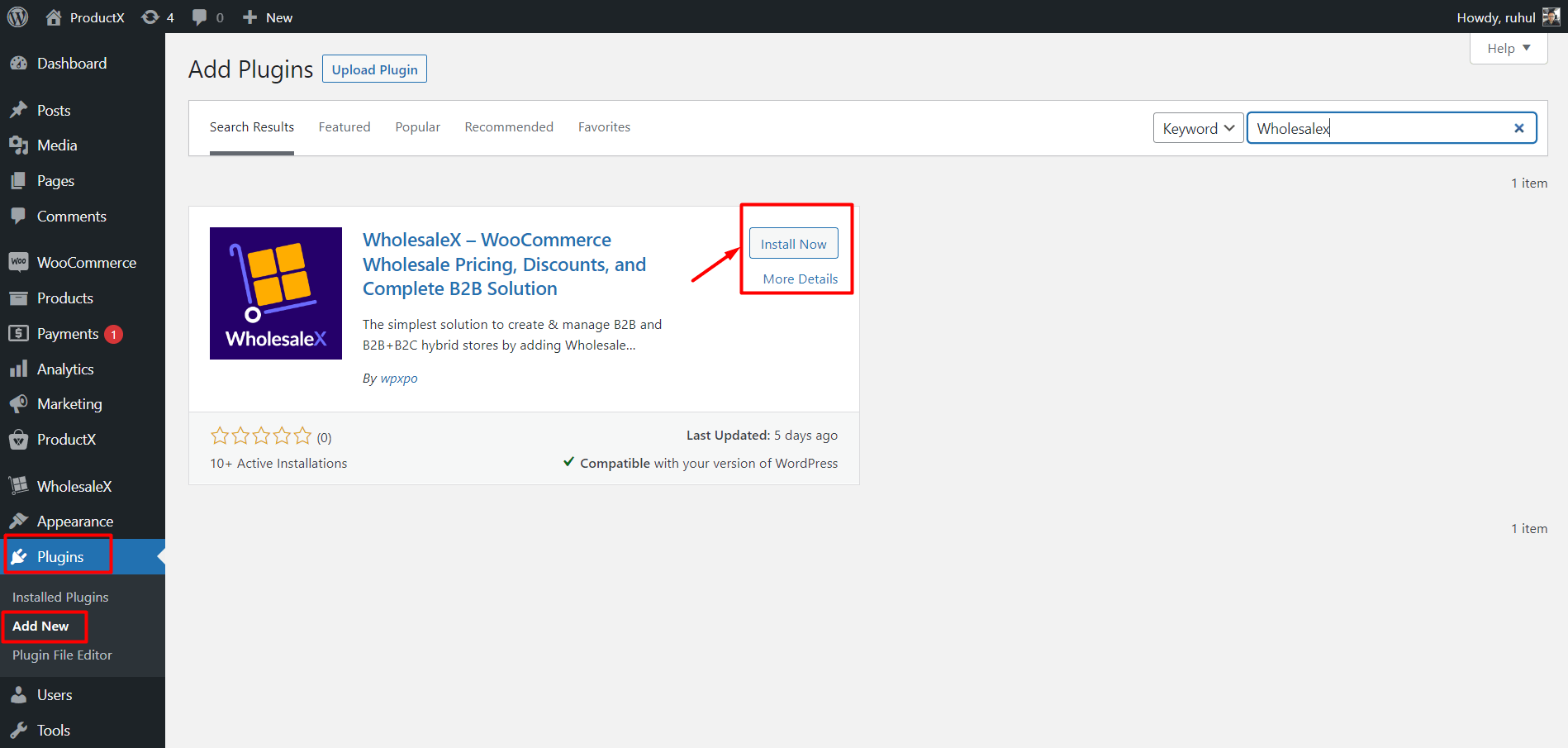

First, you must install WholesaleX to set up different discounts, including user role-based pricing.

- Go to the “Plugins” section on your WordPress dashboard.

- Then click on “Add New.”

- On the right search panel, type “WholesaleX.”

- You should now see the WholesaleX plugin.

- Click on “Install.”

- Then you can click on the highlighted “Activate” button.

WholesaleX gives you ultimate freedom to set wholesale discounts on different set of variables.

Setting WooCommerce Tax Exempt Feature from WholesaleX Dynamic Rules

Dynamic Rules is only one of the many remarkable WholesaleX features. Today, we will use WholesaleX’s dynamic rules to configure the tax exemption option for WooCommerce.

Step 1: Go to WholesaleX Dynamic Rules

First, you need to go to WholesaleX→Dynamic Rules.

This is WholesaleX’s most outstanding feature. In addition to tax exemption, you can do a lot more with it.

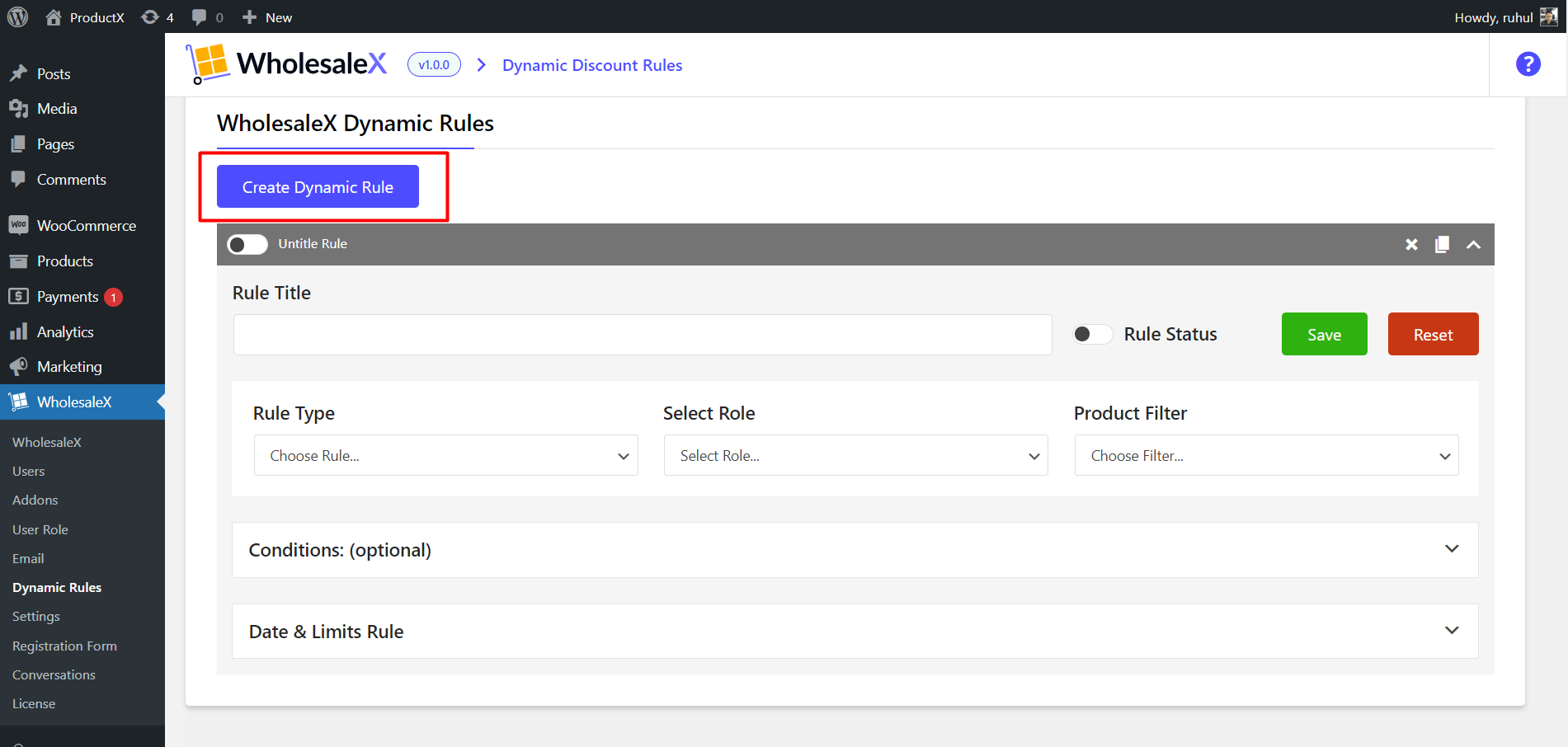

Step 2: Create a Dynamic Rule

Now you need to create a rule for your WooCommerce role-based shipping method.

Click the “Create Dynamic Rule” button to create a new rule.

The created rule will be named the “untitled rule.” Once you expand the rule bar, you can start customizing it.

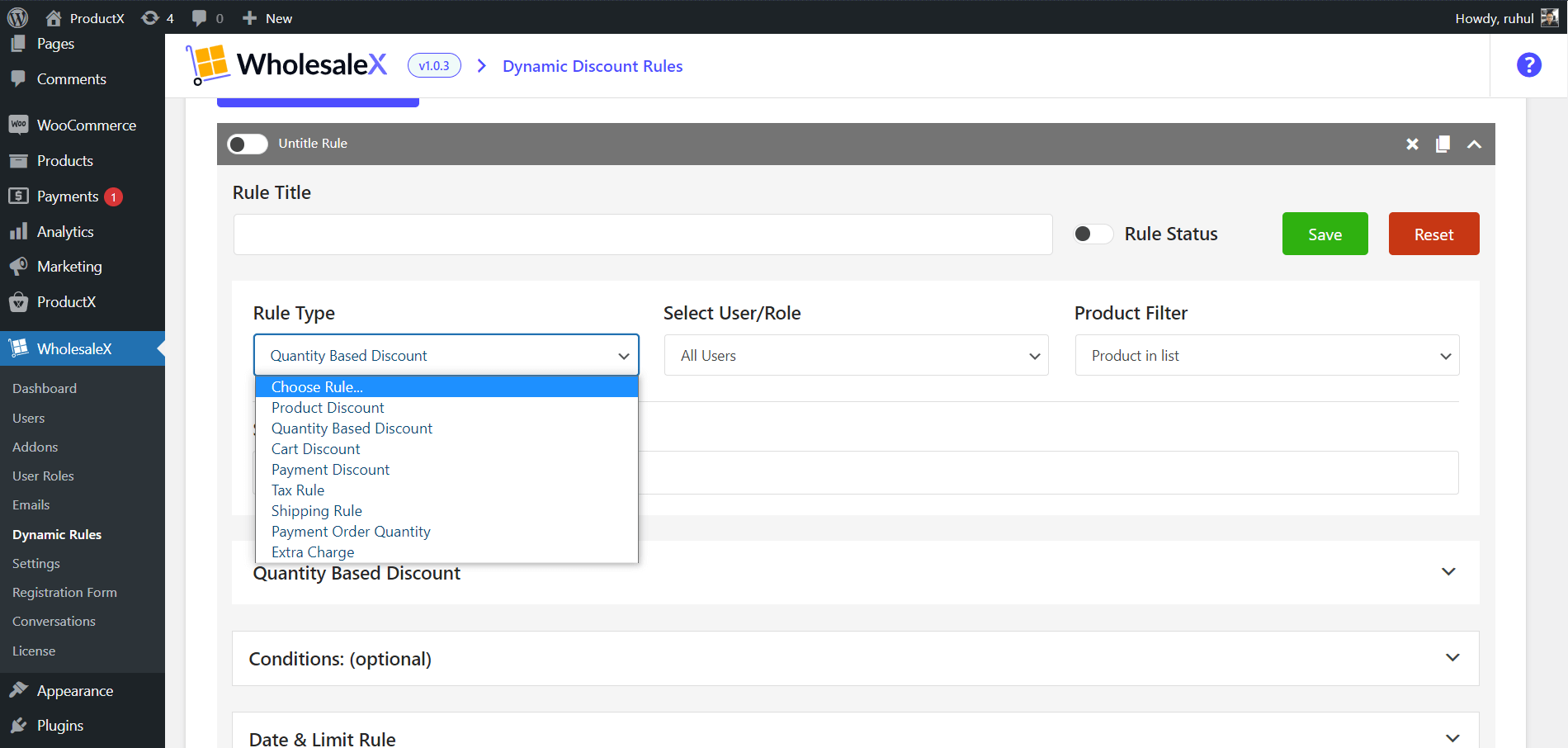

Step 3: Select Rule Type

Now you have to select the rule type.

We will pick the “Tax Rule” option from the dropdown.

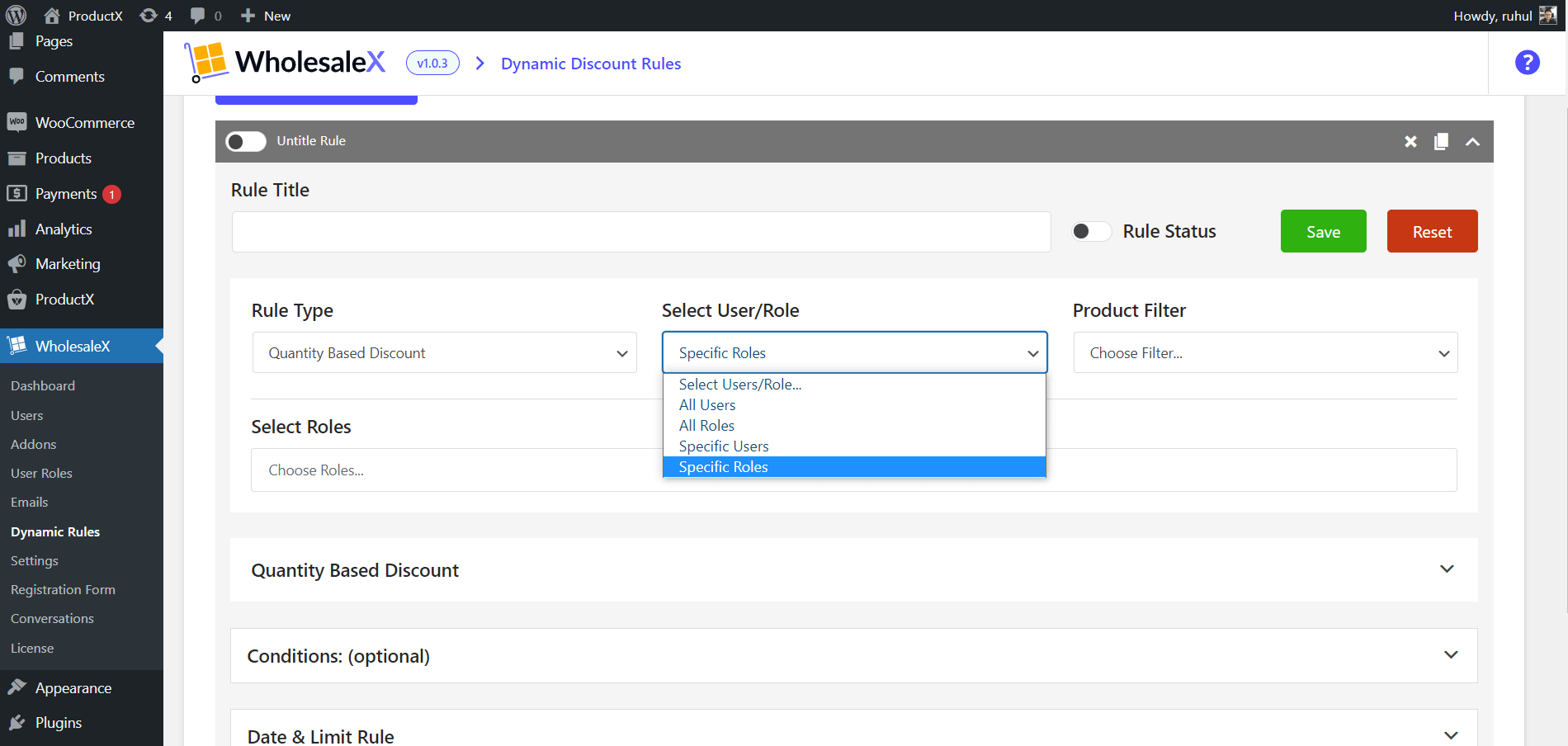

Step 4: Select User/Role

With WholesaleX, you can easily create user roles and assign them specific shipping methods.

All you have to do is select “All roles” or “specific roles” from the dropdown menu to give discounts to your customers.

Additionally, you can set a role-based shipping method for each chosen role.

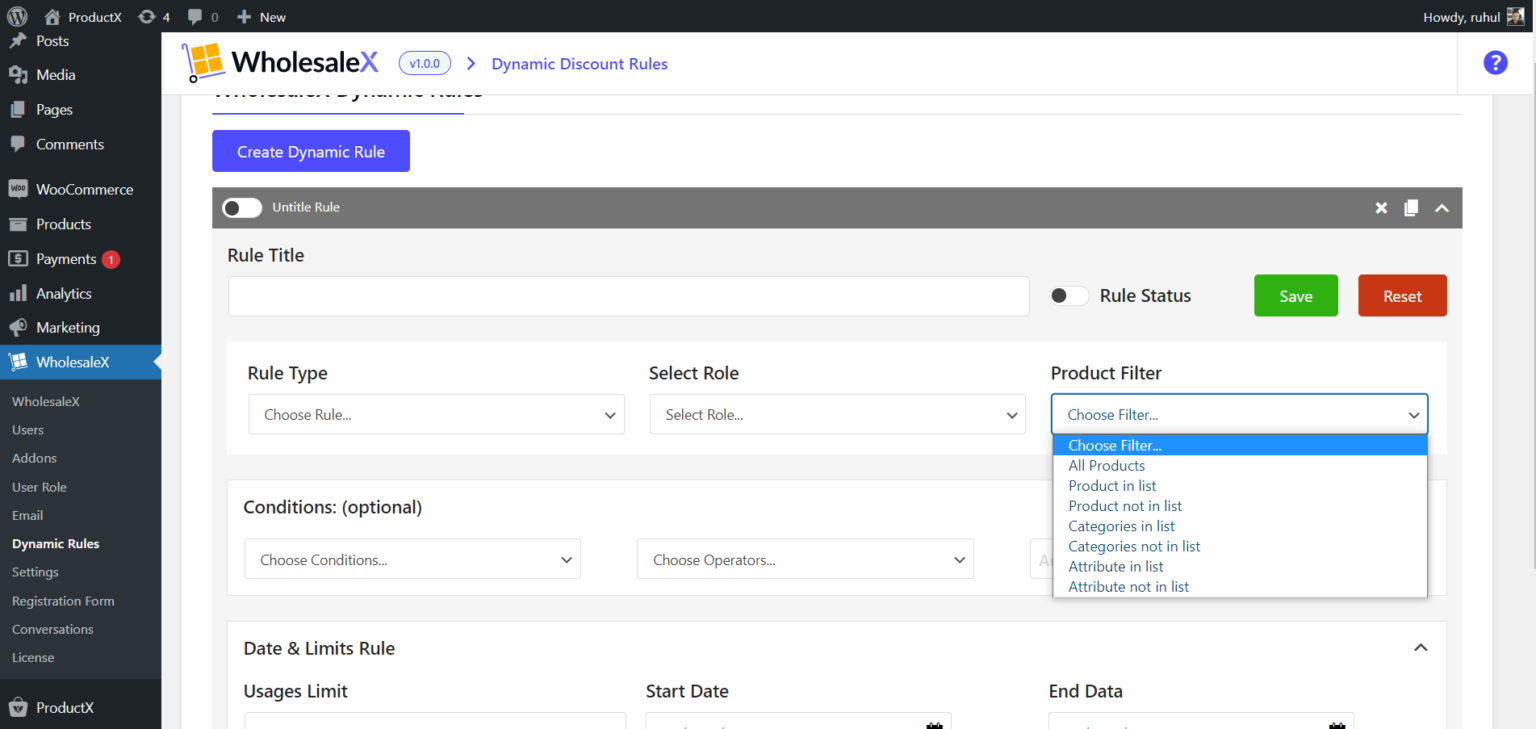

Step 5: Product Filter

Now you need to filter the products you want to give tax exemption.

Choose all or specific products, categories, and even more to which you want to set the tax exemption.

You can use WholesaleX to set tax exemptions for all or specific products, categories, and more. If you want to apply tax exemption to every product or just certain ones, you can do that with WholesaleX. By filtering the products you want to give tax exemption, you can select all or specific products, categories, and more.

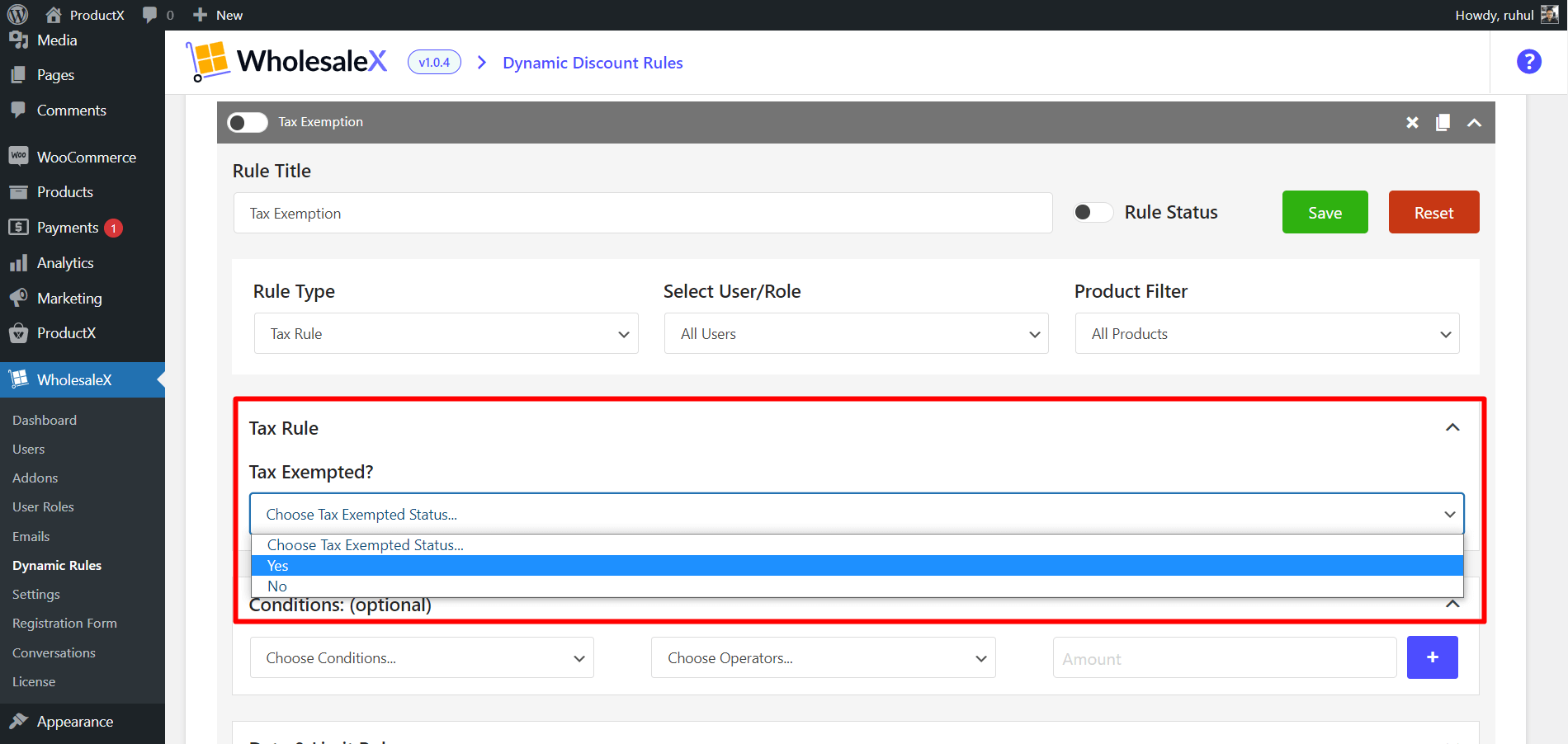

Step 6: Tax Rules

Now comes the option to exempt tax or not.

In the “Tax Rule” section, under the “Tax Exempted?” dropdown menu, select “Yes” to set tax exemption.

You can select “No” if you don’t want to give a tax exemption.

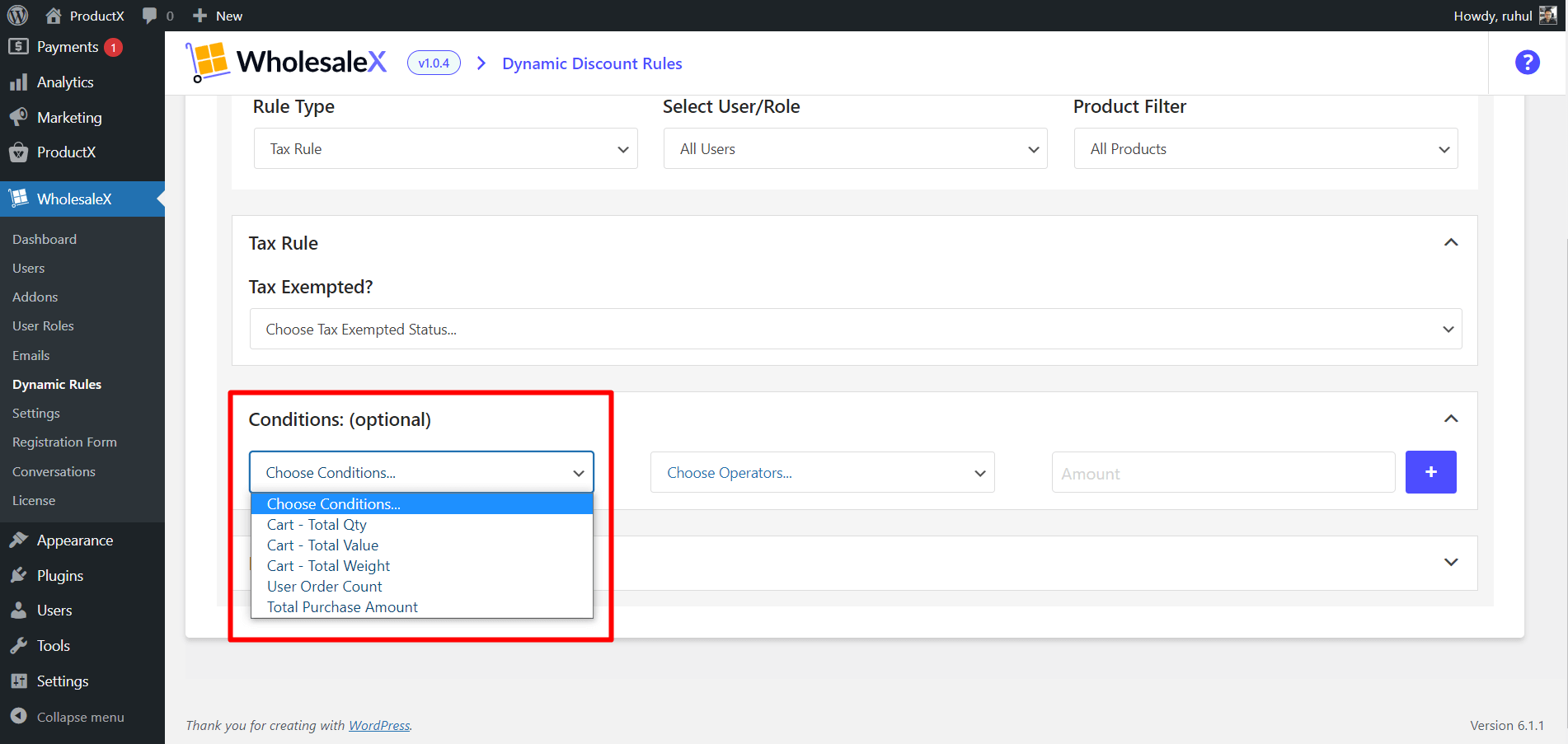

Step 7: Additional Opportunities

WholesaleX also gives you extended opportunities and lets you customize the WooCommerce tax-exempt feature more.

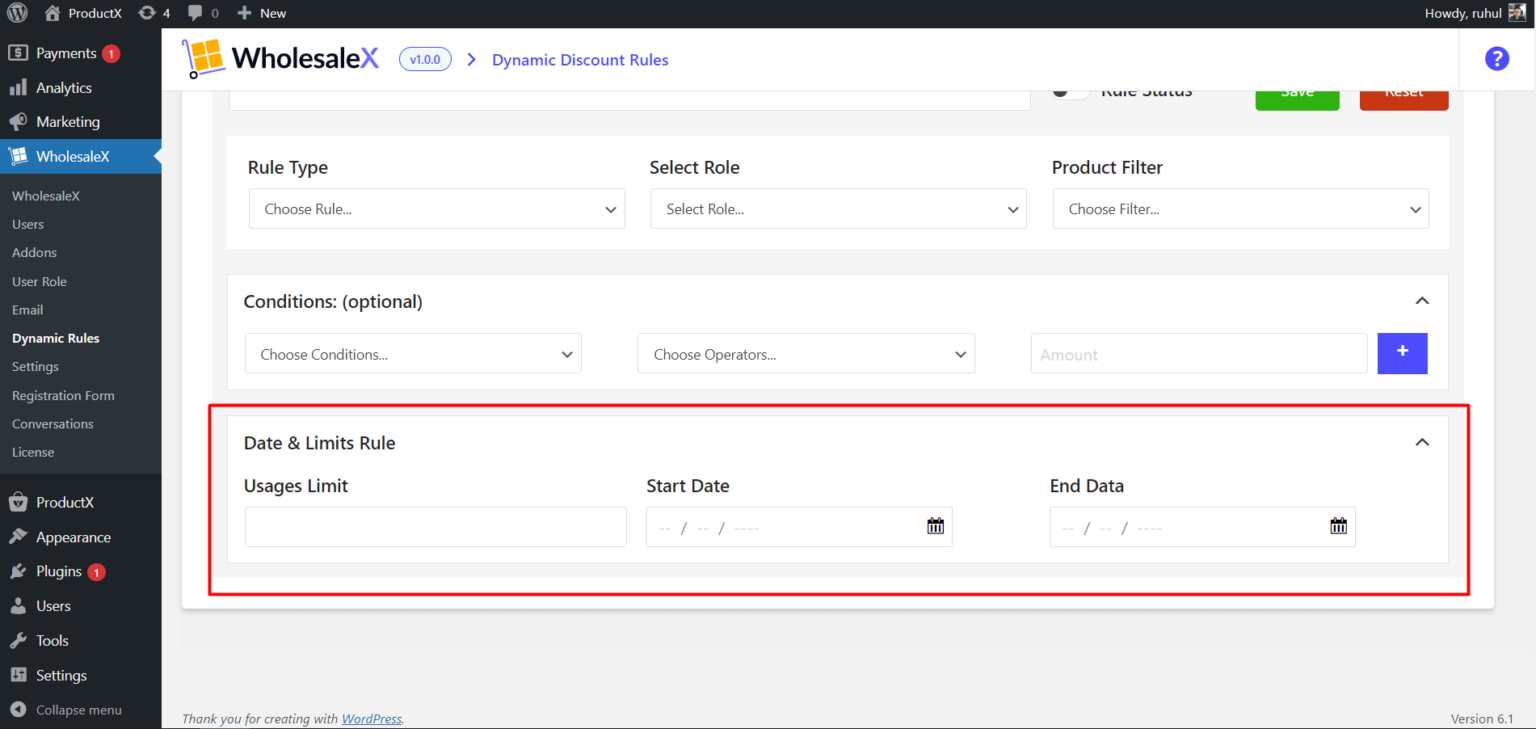

In the “Conditions: (optional),” you will have some more settings, like:

- Cart – Total Qty [Exempt tax on the overall quantity of products in your cart. Ex: Set the value to 100; the users will get tax exemption when they add 100 or more of the same product to their cart.]

- Cart – Total Value [Exempt tax on the overall value of products in your cart. Ex: Set the value to 100, then the users will get tax exemption when their total purchase value exceeds 100.]

- Cart – Total Weight [Exempt tax on the overall weight of products in your cart. Ex: Set the value to 100; the users will get tax exemption when their total purchased product weight reaches 100.]

- User Order Count [Exempt tax on the overall product count in your cart. Ex: Set the value to 10, then the users will get tax exemption when they order their products for the 10th time.]

- Total Purchase Amount [Exempt tax on the total purchase amount in your cart. Ex: Set the value to 1000, then the users will get tax exemption when their total purchased product amount exceeds 1000.]

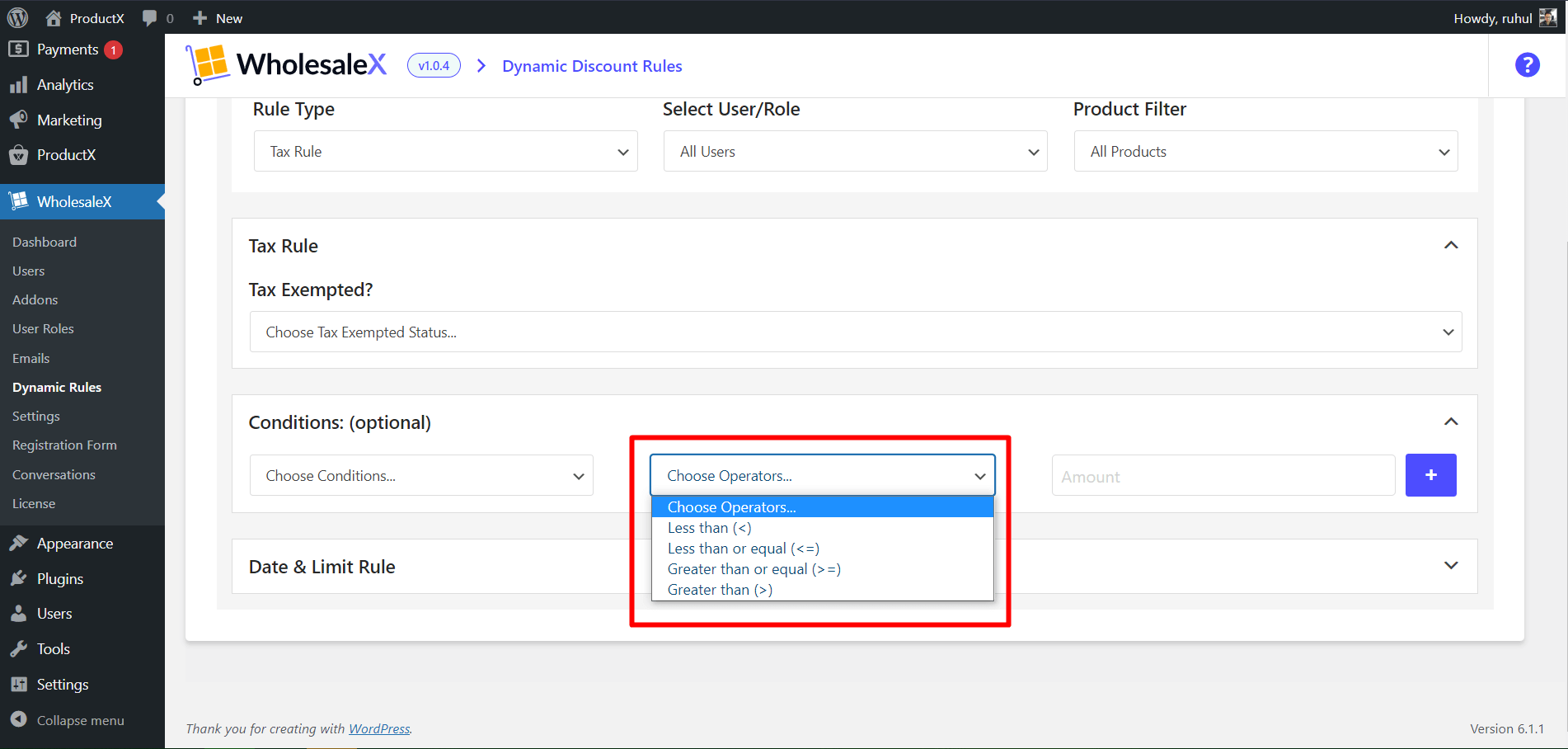

In the “Choose Operators,” you can choose the following defining variables:

- Less than (<)

- Less than or equal (<=)

- Greater than or equal (>=)

- Greater than (>)

In the “Amount” box, you can write the amount for the previously selected variables.

WholesaleX also has the “Date and Limit Rule” if you want to run your WooCommerce tax exemption for a certain amount of time.

When you’re done, click “Save.” You’ve completed the setup procedures of the WooCommerce tax exemption feature.

Setting WooCommerce Tax Exempt Feature from WholesaleX User Roles

WholesaleX makes it simple to create user roles. In addition, the WooCommerce tax exemption feature can be enabled while creating user roles. How? Let’s explore it.

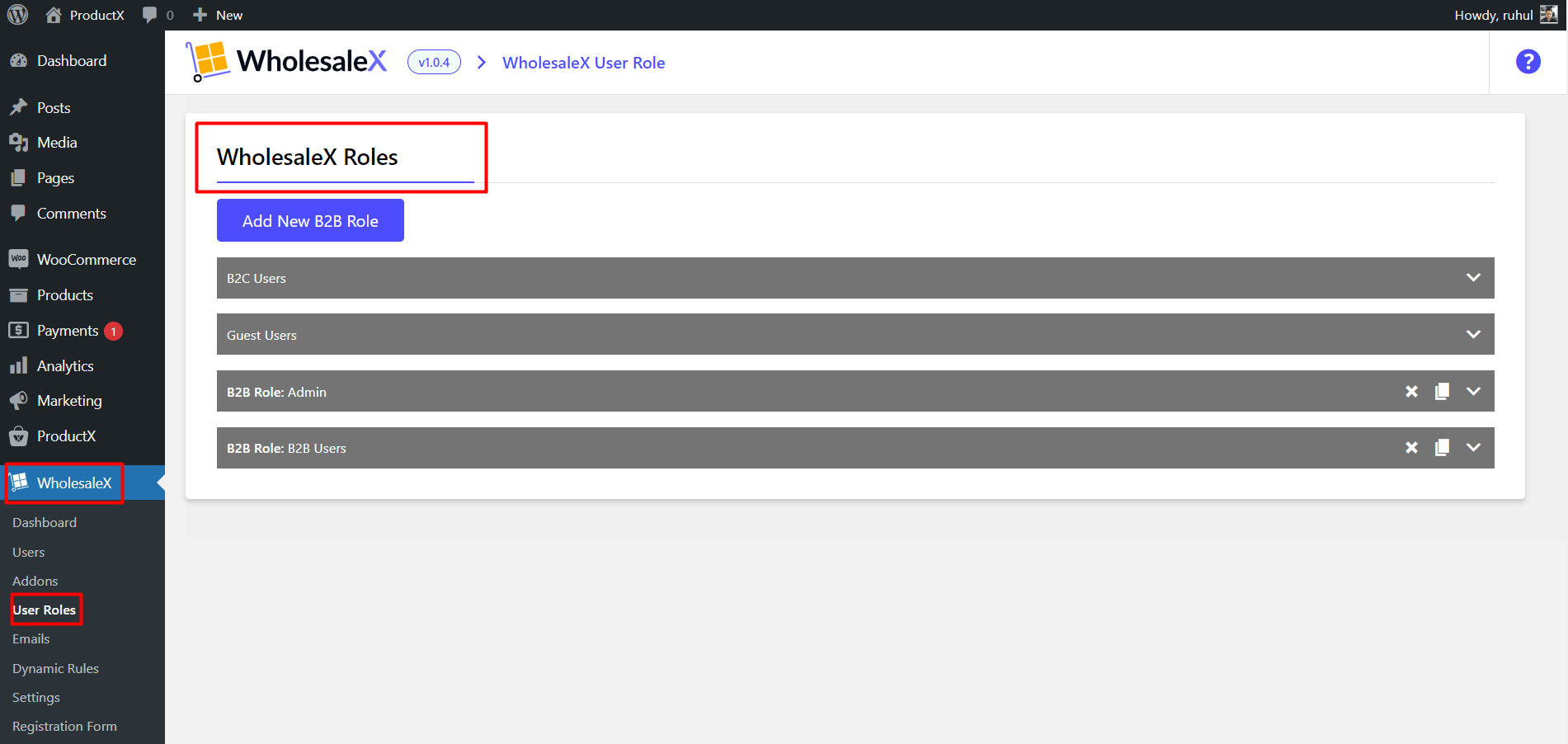

Step 1: Go to WholesaleX User Roles

First, you need to go to WholesaleX→User Roles.

You can create and modify B2B user roles in this section to fit your specific requirements. Additionally, select different settings while creating it.

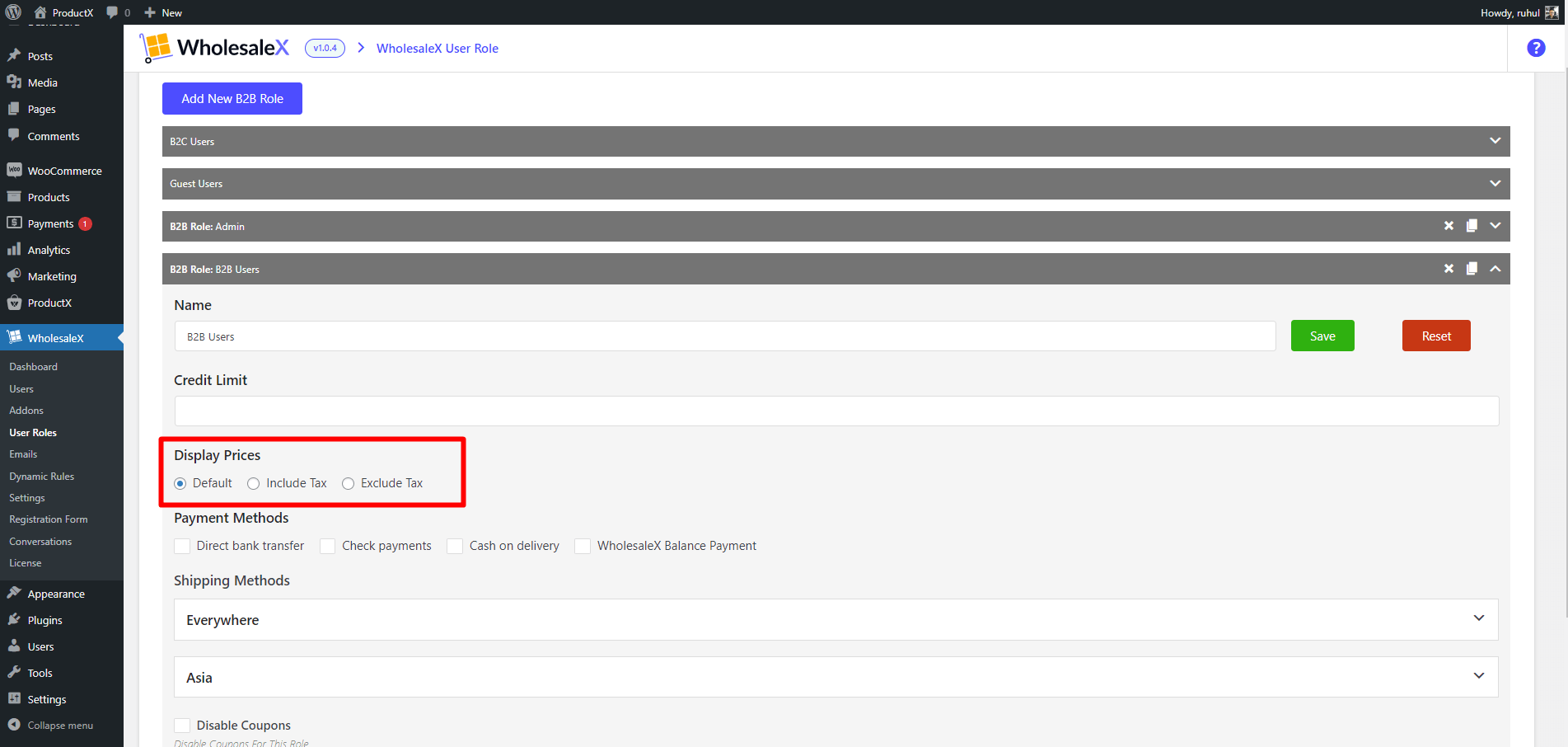

Step 2: WholesaleX User Roles Settings

Expand a user role after creating it. You will discover plenty more customization options.

In the “Display Prices” section, you’ll see 3 options. Which are:

- Default

- Include Tax

- Exclude Tax

Select the “Exclude Tax” option to implement the tax exemption feature.

You can also see other settings like shipping methods selection, adding WooCommerce Store Credits, changing the name of the roles, and many more.

Benefits of WooCommerce Tax Exemption

Now that we know what WooCommerce tax exemption is, let’s dig into some of its benefits.

Improved Efficiency

- Automatically apply tax exemptions to customers who meet the criteria.

- Streamline the process of applying tax exemption status to customers.

- Eliminate manual paperwork and record-keeping associated with tax exemption.

- Reduce data entry errors associated with the manual processing of tax exemption applications.

- Save time and resources associated with manual processing.

Improved Customer Experience

- Make the tax exemption process more accessible and more convenient for customers.

- Provide customers with a better understanding of their tax exemption status.

- Reduce confusion and frustration associated with the process of applying for tax exemptions.

- Improve customer satisfaction by eliminating the need for manual paperwork and data entry.

- Increase customer loyalty by providing a more efficient and user-friendly process for applying for tax exemptions.

Improved Security

- Reduce the risk of fraud and abuse associated with the manual processing of tax exemptions.

- Securely store customer information associated with tax exemption applications.

- Ensure the accuracy and integrity of the tax exemption data.

- Provide enhanced data privacy and security for customers.

- Automatically validate customers’ eligibility for tax exemption.

Improved Compliance

- Automatically apply the most current tax exemption laws and regulations.

- Ensure accurate and timely filing of tax exemption applications.

- Eliminate outdated or incorrect information associated with tax exemptions.

- Ensure consistent and accurate filing of tax exemption documents.

- Reduce the risk of penalties associated with non-compliance.

Improved Cost Savings

- Reduce the cost of manual processing associated with tax exemption applications.

- Lower the cost of filing and maintaining tax exemption records.

- Eliminate the cost of printing and mailing paper tax exemption forms.

- Reduce the cost of maintaining multiple databases and systems for tax exemptions.

- Lower the cost of employee time spent on manual processing of tax exemptions.

Improved Accuracy

- Automatically apply the most up-to-date tax rates and exemptions.

- Eliminate data entry errors associated with the manual processing of tax exemptions.

- Reduce discrepancies between customer data and tax exemption information.

- Ensure accurate calculation of tax exemptions for customers.

- Streamline the process of collecting, updating, and maintaining customer information.

Improved Transparency

- Increase transparency in the process of applying for tax exemptions.

- Make the process of applying for tax exemptions easier to understand.

- Provide customers with a better understanding of their tax exemption status.

- Make the process of applying for tax exemptions more transparent to customers.

- Make tax exemption information easily accessible to customers.

Improved Scalability

- Automatically scale tax exemption features to meet changing customer needs.

- Automatically update tax exemption features to meet changing regulations.

- Easily manage multiple tax exemption applications from different customers.

- Reduce the time and effort spent on managing tax exemption applications.

- Increase the efficiency of managing tax exemption applications.

Conclusion

In conclusion, the WooCommerce tax-exempt feature is an excellent way for merchants to ensure compliance with local and international tax laws while saving time and resources when managing taxes. This feature can simplify the process of managing taxes and provide customers who are exempt from taxes with an easy way to avoid paying them. Additionally, this feature can help merchants to save money by reducing the cost of international transactions.

You can check out WordPress video tutorials on our YouTube Channel. Also, find us on Facebook and Twitter for regular updates!